Starting out as a small business owner is an exciting (and sometimes overwhelming) time. There are so many questions to ask yourself like, “How do I register a small business in Ontario?” or “How do I get a copy of my Ontario business registration certificate?”.

It may seem like there’s a mountain of paperwork to fill out and legal language to weed through ahead, which can be daunting. Remember that you’ve taken a leap of faith on your great idea and have begun the steps of bringing your product or service to market, which is the first step to becoming a successful entrepreneur!

To ensure your business is on the path for growth, there are some logistical actions that must be taken. Registering your business is one of those first steps. Read on for Ownr’s guide on everything you need to know about starting your small business in Ontario , from determining a business structure to the steps and application fees for registering.

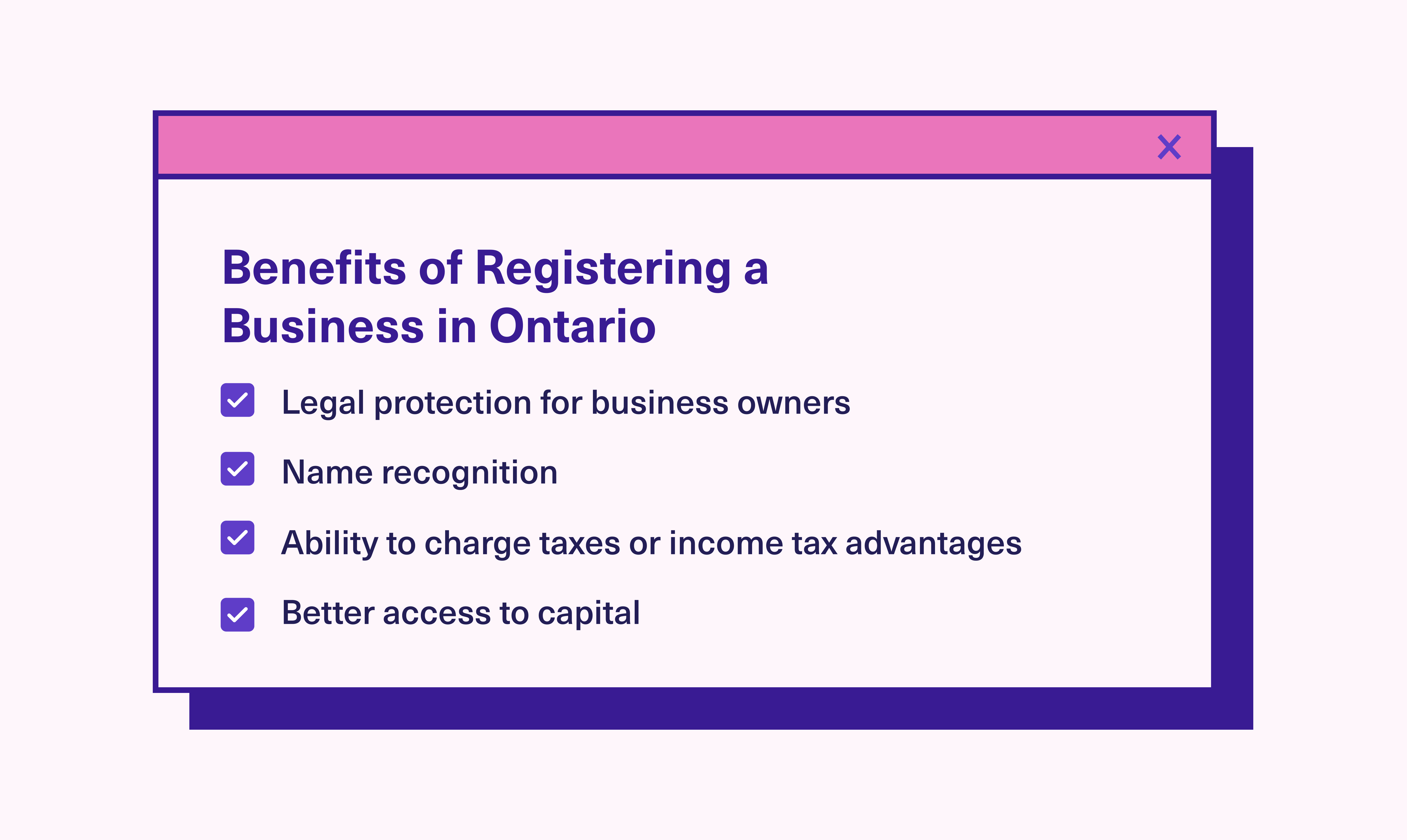

Beyond allowing the provincial government to keep track of all those doing business dealings within Ontario, there are reasons why you as a business owner will want to formally register your business. Some of these include:

In most cases, you will need to register your business in Ontario with the Ontario Business Registry. One exception is if you are operating your business as a sole proprietorship under your exact legal name. You will need to register your business if it is:

There are a number of business structures for registering your business in Ontario. These include sole proprietorships, partnerships, corporations, or Limited Liability Partnerships (though you must be a lawyer, accountant, or another regulated professional to form an LLP). For a more comprehensive understanding of all business types, read our article on how to choose a business structure . With this said, the majority of the businesses fall into either sole proprietorship, partnership, or corporation, so we’ll focus on these three types.

Note: We strongly encourage you to seek independent legal advice before proceeding with your business structure rather than solely relying on online resources like this article.

Registering a sole proprietorship and a partnership have many commonalities. The difference is that you are the only owner in a sole proprietorship. The sole proprietorship business registration process is the simplest and least expensive method of registering a business in Ontario. It does, however, offer the least amount of legal protection.

Registering a partnership is nearly as simple as a sole proprietorship, and the costs are also comparable. You will have to make a choice to either register as a general or limited partnership. The difference? A general partnership usually involves a fair split between all partners.

A limited partnership acknowledges that some partners are not equally as involved and therefore don’t get compensated in the same way.

There are several similar steps to registering both a sole proprietorship and a partnership. Most of those steps involve registering a name for your business under the Ontario Business Names Act (BNA). You don’t have any legal obligation past registering your business name when forming a partnership or sole proprietorship.

However, it’s important to note that in a partnership or sole proprietorship, there is no distinction between you and your business in terms of legal and financial liabilities.

For example, you (and your partners) may be personally responsible for your business debt. This is not the case when you are incorporated . Here are 3 steps you need to register a sole proprietorship or partnership in Ontario:

Unless you’re using your own legal name, you have to choose a distinct business name (since two businesses cannot operate using one same name under the same jurisdiction ). Even if your name is Kim Jones and you want to call your business “Kim Jones Flowers”, your business still needs to be registered.

Your business name also cannot be misleading. For example, you can’t call yourself “Kim Jones Inc.” because you’re not a corporation. Your business name will stay registered for five years, at which point you’ll need to renew your registration. You have 60 days from the time your name expires to complete the renewal.

Now that you’re happy with a unique name for your business, it’s time to officially register your sole proprietorship or partnership through ServiceOntario. Here’s what you’ll need to prepare in advance:

Once your business is registered, you’ll receive a nine-digit BIN number ( Business Identification Number ). This number is what identifies it as registered in Ontario. With your BIN number, you can now open a business account, access wholesale pricing from suppliers, advertise your business and operate in Ontario for five years or until you decide not to renew your registration.

What the BIN doesn’t do is protect you as an individual from liability. For instance, if you take out a business loan under your business name but can’t pay back that loan, you will personally be liable. A BIN also doesn’t give you any corporate tax benefits or protect your name from being used by other businesses. These are all benefits of fully incorporating your business.

You’ll have to operate your business under provincial regulations. That may require you to collect HST for your business , in which case you’ll need to create a GST/HST account . You may also need to register for Workers’ Compensation Insurance. Even though you’re only operating as a sole proprietor, it’s still important that you take this step of identifying any licenses or certificates you need in order to operate legally. Do this research even if you’re operating under your own name and haven’t registered a unique business name.

If you choose to register or renew your partnership or sole proprietorship application directly with the government, there are costs for several items . To register or renew your business name, it costs $60 online, by mail or email for a sole proprietorship or a general partnership; and it costs $210 for a limited partnership. There are additional costs for the name search report (typically around $25 for a NUANS name report).

Incorporating your business means you’re essentially creating another legal entity. Your business will have the rights and liability protection that is similar to a person’s. What’s important to remember is that these rights are only extended provincially. You’ll have to incorporate federally for those benefits to be recognized across the country. Read Ownr’s guide on whether incorporation or a sole proprietorship is right for you.

For the above reasons, the registration requirements for incorporating your business in Ontario are more detailed and expensive than incorporating as a sole proprietorship or partnership: you’ll have the option to register either a business name or a business number, and a set of documents called Articles of Incorporation , which is essentially a summary that outlines the purpose of your business. There are a lot of steps to incorporate, so take your time to make sure nothing is missed if filing yourself.

If you decide to incorporate using a unique business name (opting over a business number), similar to a partnership or sole proprietorship, it’s a good idea to start with a basic name search. Once you’ve determined that you can proceed with your name, it’s time to run a formal business name search against the government database (called the NUANS name search ), which is necessary before you take the next step of completing your Articles of Incorporation.

You can file your application to receive your Certificate of Registration once you’ve completed your Articles of Incorporation. Depending on the type of business you’re starting, you may also need some supporting documents (for example, construction businesses). If you are filing an application form for the first time, pay special attention to fields that can be confusing and easily filled out incorrectly, for instance, “other provisions”. This is one of the benefits of using Ownr’s platform – it assists with tips and explains legal jargon in plain language throughout the entire process.

As an incorporated business in Ontario, it’s mandatory for you to keep corporate records, (called a Minute Book ). The minute book describes all the activities of your business, including the following:

It doesn’t matter how big or small your corporation is or what consumer services you offer. Keeping a minute book is a legal requirement for all incorporated businesses, be that provincially or federally.

Incorporating yourself directly with the Ontario government costs $300, plus an additional fee for NUANS search ($25 for provincial). The process can be difficult to navigate and time-consuming, and what’s more won’t actually give you everything you need to complete your incorporation. Many people opt out of this option and prefer assistance from a legal professional which can get pricey—incorporating with a lawyer can cost $1,500 or more.

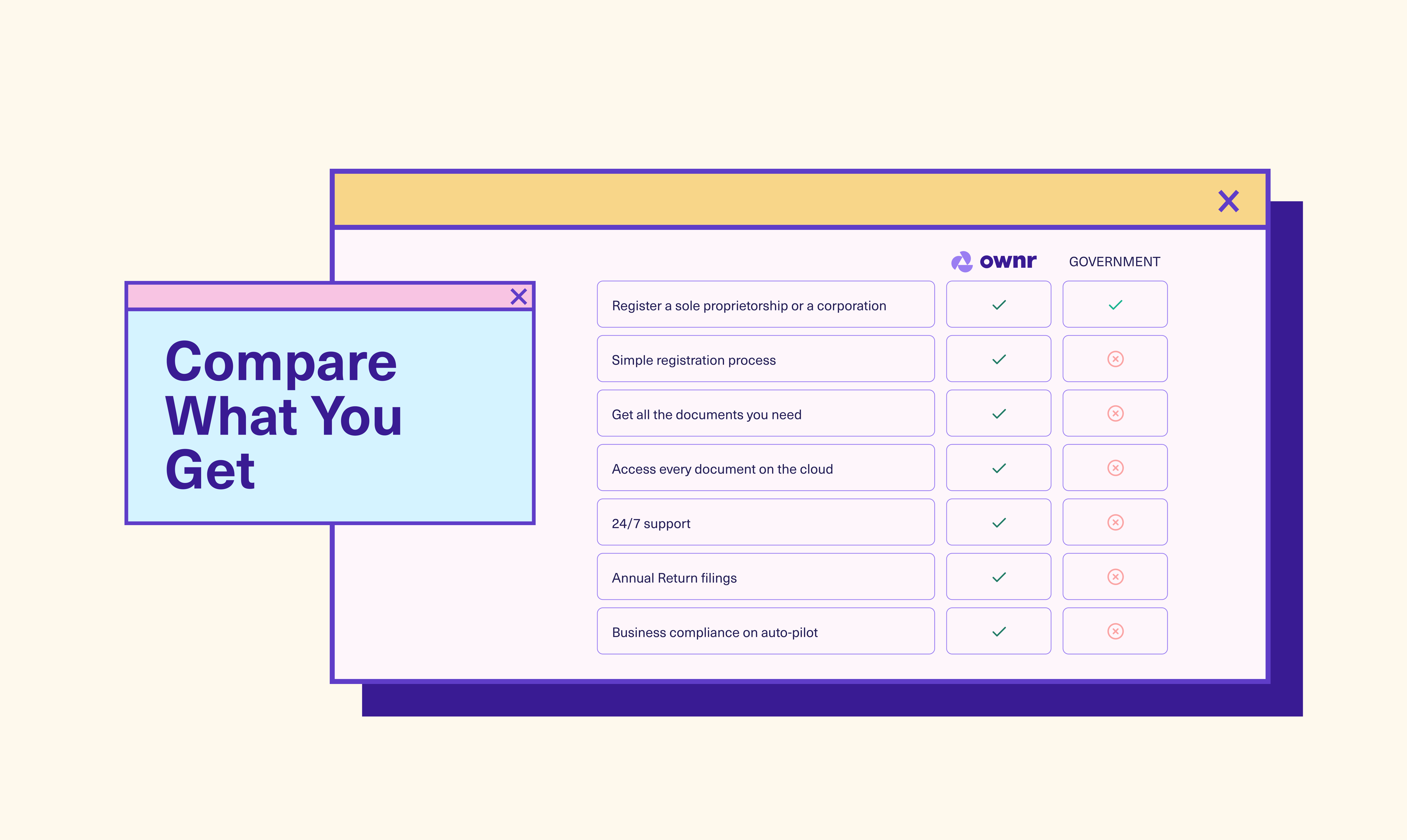

Deciding on the right business structure and registering your enterprise is an important step as you grow your small business. Ownr offers a much simpler process than if you were to file yourself with the government at just a fraction of the cost of hiring a lawyer. Using Ownr, you can register your sole proprietorship or incorporate your business i n Ontario in just minutes. Sole proprietorship set-up with Ownr costs $49, and Ontario provincial incorporation packages start at $599 or opt for federal incorporation for $499.

The incorporation fee provides you with up to 30 free business name searches, and all mandatory documents (including the NUANS report, Articles of Incorporation, and a digital Minute Book for one year). In addition, if you open a new business account with RBC after incorporating with Ownr, you’ll get $300 back* .